$12,500,000 GTD WIN LIFE-CHANGING MONEY OUR BIGGEST TOURNAMENT EVER!

2937 Players Registered! Last updated 04/25 8:00 EST

Why would you play poker

anywhere else?

Home of the $12.5 Million GTD Venom Tournament

Massive daily tournament schedule

More deposit options than any other site

Millions won by our players every single day

Dealing cards for over 20 years

Fastest payouts in the industry

We take your safety and security seriously

DATA PROTECTION

We believe in honesty and transparency. Always.

SINCE 2001

We've been dealing cards for decades, and our focus on you keeps getting stronger.

BOTS

We’re always standing on guard to make sure bots stay off the tables.

PRIVACY

We use top bank-grade encryption and do everything we can to make sure your info stays private.

A WORLD OF POKER ENTERTAINMENT AWAITS!

It just takes a minute to create your free account and load it with cash. Once you’re good to go, you’ll have unlimited access to the hottest poker promotions, biggest tournament action, nonstop cash game thrills, and everything you need to fill your day with poker awesomeness. All this plus a casino games, and so much more.

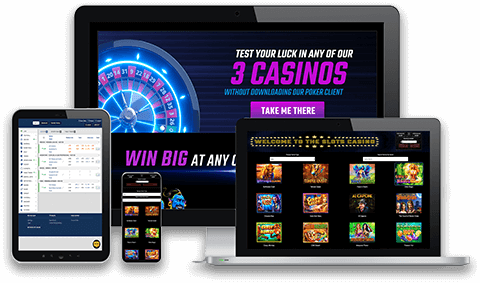

HIT THE CASINO. ANYWHERE. ON ANY DEVICE.

WE BREAK RECORDS

When you join ACR, you become a member of a site that breaks records.

The biggest guarantees, the biggest payouts, the largest tourney selection.

Sign me up!

MAXIMIZE YOUR INCOME

EARN PASSIVE INCOME THROUGH AFFILIATE MARKETING

Join the WPN Affiliates Program and receive a CPA commission with every active player you bring to the site.

CLICK HEREOur timeline

2001

Opened Doors to Worldwide Players

2011

Joined Winning Poker Network

2012

Launched First Weekly Beast Point Race

2014

Hosted First $1M GTD Tourney

2015

Began Accepting Bitcoin

2018

Launched Cage Live in Costa Rica

2022

Hosted Record $10M Venom